Summary of content

With the introduction of the ‘Your Future, Your Super’ legislation into parliament the super sector’s attention is focussed on what impact the proposed performance benchmark test will have. Super Consumers Australia used current APRA data to see who the underperformers are and what might be some key contributing factors to their underperformance:

They represent a substantial proportion of all default product members (30%) and assets (17%).

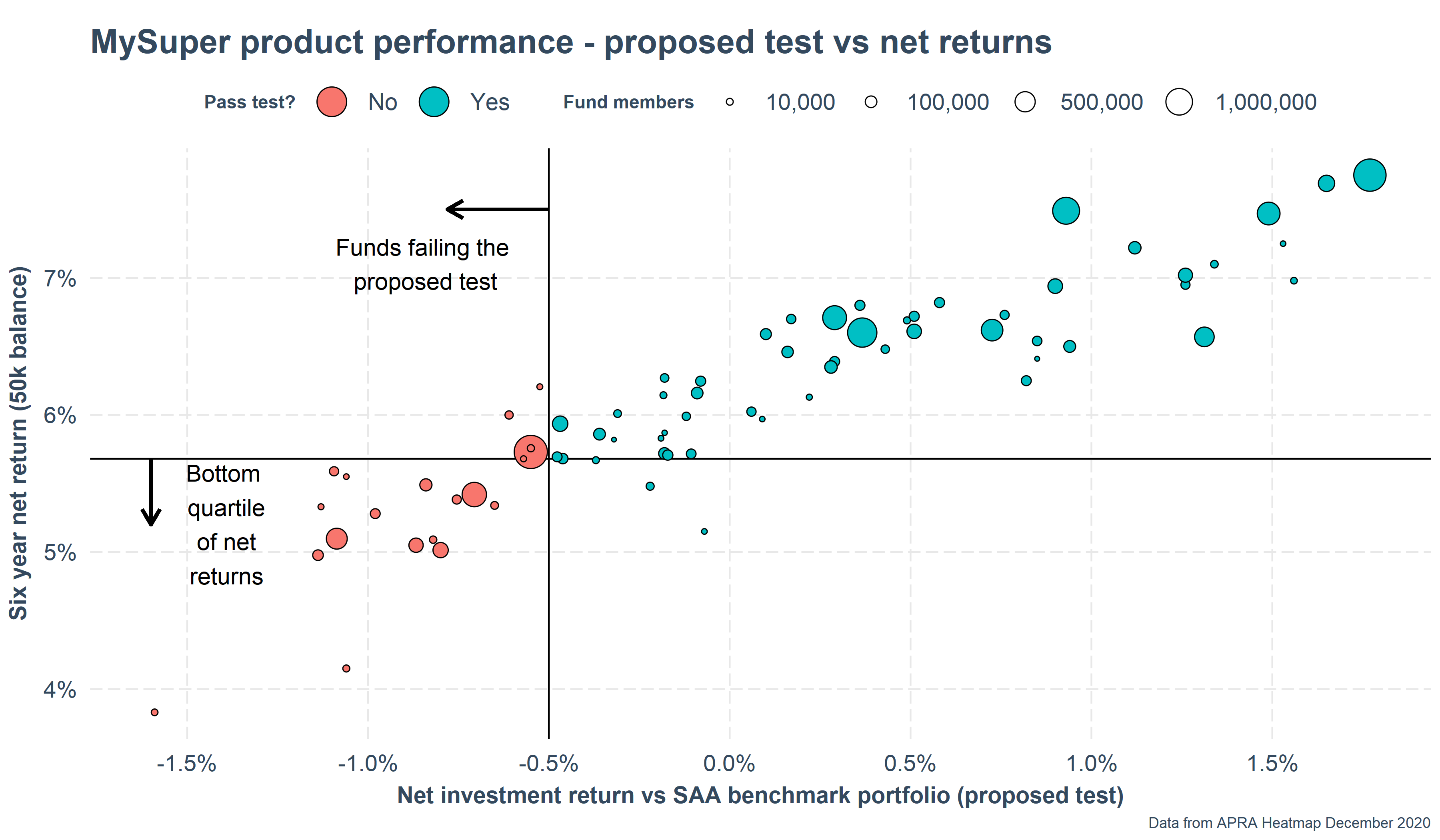

A large majority of the products that currently fail the performance test are also in the bottom 25% of net returns (see figure below).

Including administration fees in the test would lead to five additional products failing while two now pass due to low admin fees.

If all underperforming funds reduced their investment fees to the industry average, three of them would no longer fail the test.

Most underperforming funds have relatively small memberships which our previous research suggests may mean substantial scope for efficiency gains and lower member fees through merger activity.

In fact two small, under-performing funds (Maritime and VISSF) are already involved in mergers or ‘quasi-mergers’ with larger, better performing funds.

The proposed performance test

In December 2020, Treasury released the main features of the Your Future, Your Super legislation, which included an investment performance test for default (MySuper) products to be enacted from 1 July 2021 and extended to all ‘Trustee directed products’ (TDP’s) by 1 July 2022.

The metric employed for the test is one that is currently published in the APRA MySuper product heatmap. This allows us to analyse which products currently fail the proposed test.

Underperforming products as a proportion of system assets and members

| Fails test? | Fund members | % members | Total assets | % assets |

|---|---|---|---|---|

| No | 9,339,893 | 70% | $579.50bn | 83% |

| Yes | 3,910,075 | 30% | $118.99bn | 17% |

The funds currently failing on the performance metric used by the proposed test represent a substantial portion of system assets and members. Table 1 shows that 30% of all MySuper accounts and 17% of total assets under management are held in funds currently failing the proposed test.

Overlap between failing the proposed test and low net returns

The proposed test assesses a super fund’s ability to implement its investment strategy. It compares the eight year (or life of the product if less) net investment return (NIR) of the product with the NIR of a benchmark portfolio. The benchmark portfolio has the same (strategic) asset allocation as the product but only invests in listed index funds that track the market. Thus the test measures the value of any active management of the portfolio as well as investment in complex/illiquid assets.1

The product gets a 50 basis point buffer, meaning it can underperform against the benchmark portfolio by a fair amount, but still pass the test. This is intended to ensure the test only fails products with poor management that causes sustained underperformance and not those that underperform slightly due to market volatility.2 This method of identifying underperformance has the benefit that it accounts for situations where the product member wanted or needed the specific asset allocation of the product being tested.

However, MySuper products are aimed at a mostly disengaged audience where in many cases the member is not making an informed choice of product. It may be the case that some funds design their product appropriately for the (assumed) risk preferences of their membership. However, most MySuper products are single strategy and designed to meet the needs of the general population, so in most cases a conservative investment approach that leads to lower net returns would be inappropriate. What that means is that another reasonable metric for assessing underperformance is how a MySuper product performs relative to its peers.

This led us to investigate whether funds which fail the proposed test also tend to have low returns relative to their peers. Figure 1 shows that 16 of the 20 products that currently fail the proposed test also produced six year net returns (the return received by the member once fees and taxes are deducted) that are in the bottom 25% of all funds. The fact that the products the proposed test highlights are largely the same as those in the bottom quartile of net returns indicates that the test is picking up the right funds.

The impact of including administration fees in the test

Publicly available data (the APRA MySuper heatmap) allows us to model the impact of including fund administration fees in the proposed test. In order to add administration fees to the test we first need to decide what is a reasonable fee rate to compare investment options to. We chose the member-weighted median administration fee for all MySuper products as it accounts for the fact that members are not evenly distributed between products.

We found that including administration fees in the test led to five additional funds failing the test as well as two funds passing the test that had previously failed.

Overall, including administration fees increased the number of underperformers from 20 to 23.

The cost of spending an entire working life in one of the high admin fee funds that fail the test, rather than an average MySuper product, is a $92,000 lower balance at retirement.

Reducing underperformance by lowering investment fees

The Productivity Commission felt that the most realistic option for funds failing the performance test to lift their performance would be to reduce their fees.3 While the test proposed by the Commission is the origin of the proposed test, the current version does not include administration fees as the Commission recommended. This means, without amendment, funds only have scope to reduce their investment fees to avoid failing the test.

We looked at what magnitude of reduction would be required for under-performing funds to avoid failing the test. We found that:

If under-performing products reduced their fees to the member-weighted median investment fee (0.68%) for all MySuper products, three of them would no longer fail the proposed test.

This would require a nine basis point reduction on average for the under-performing products which did not already have investment fees below the MySuper median.

If the underperformers reduced their fees to equal or below the investment fees of the 25th percentile (the quarter of the market with the lowest investment fees) of all MySuper products (0.56%), five of them would no longer fail. This is a quarter of all underperformers.

This analysis shows that for a sizable portion of the market there are reasonable fee reductions they could make in order to avoid failing the test. For the rest it should be noted that they have chronically underperformed over the long term and it is in member’s interests that a more lasting solution, such as a merger should be contemplated.

The size of underperforming products and the potential for future merger activity

| Member quartile | Range | Number of products | Percent |

|---|---|---|---|

| 1 | 458-13,200 | 7 | 35.0% |

| 2 | 15,149-54,650 | 6 | 30.0% |

| 3 | 56,005-122,731 | 2 | 10.0% |

| 4 | 126,611-1,697,231 | 5 | 25.0% |

Most of the under-performing products (65%) have fewer members than the median product and 35% are in the smallest 25% of products. Our previous research showed substantial merger activity in 2019-2020 between small, under-performing funds and larger, better performing funds. The relatively high proportion of small products suggests there may be significant scope to reduce the number of under-performers through merger activity.