People plan for retirement in very different ways depending on their skills, experience and retirement needs. The Treasury is currently consulting on a Retirement Income Covenant aimed at clarifying superannuation fund responsibilities in improving retirement outcomes for people, while enabling choice and competition.

While it is a good idea to have obligations on super funds to support people in this process, a good starting point is to understand what people want when planning for retirement. This research helps to better understand the process from a consumer’s perspective.

Early this year we commissioned a nationally representative retirement planning survey of 1,541 45-80 year olds. Three key insights from this research are:

A majority of people prefer to make financial decisions based on their own research but they have relatively low knowledge about their finances.

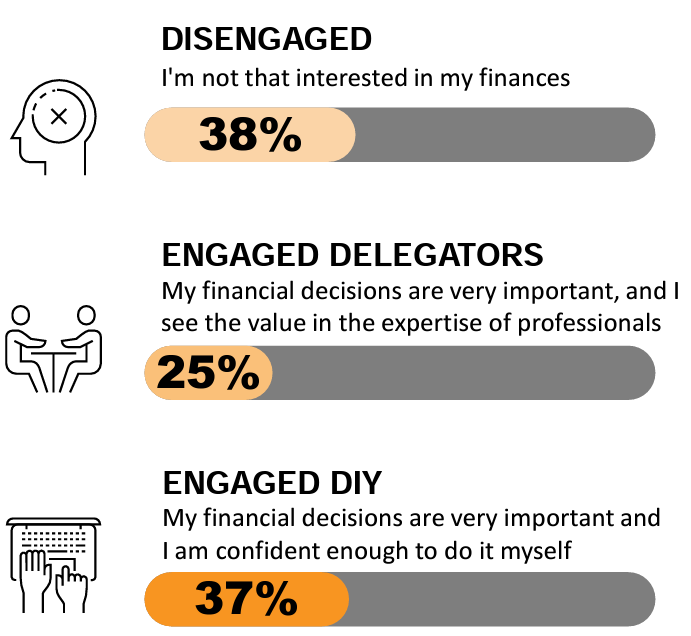

We identified three broad groups based on their engagement and knowledge about their finances (see figure 1 below). Different groups may require different solutions to help them achieve the retirement they desire.

Almost half the people surveyed felt retirement planning is moderately to extremely complicated and this view was highest among younger pre-retirees.

Today we are releasing the research relevant to these three insights to help advance the discussion around how to best help people plan for retirement.

Click here to download the research

Click here to view the article explaining the research on the CHOICE website

Figure 1: Three approaches to retirement planning based on engagement and knowledge with finances